Media › Forums › Uganda Today and what is happening in Uganda › Uganda Flip F loping in the East African Community

- AuthorPosts

- February 8, 2017 at 11:46 am #140

Eng. Kasingye Kyamugambi (L) the Project Coordinator of the Standard Gauge Railway project and Diana Apio (R) the Head of Corporate Affairs at SGR during the engagement on Tuesday’ The progress of Uganda’s part on the tripartite Standard Gauge Railway by member states of the East African Community has been slow compared to Kenya.

But in addition to that, the cost on Uganda’s project is hefty and many Ugandans have since raised concern over why Kenya and Ethiopia have had relatively cheaper railway line. It will connect Kenya, Uganda, Rwanda and South Sudan.

On Tuesday, technocrats from the Uganda Standard Gauge Railway (SGR) Project clarified on the cost variances citing geography and mileage as the major inflating factors. The railway route from Malaba to Kampala (273 kms) alone is set to cost Uganda about USD 2.3 billion.

Uganda opted for a Class One (1) railway which will be powered by electricity as opposed to Kenya’s which will run on diesel. The other three routes will be; Kampala to Mirama Hills (on Tanzania border), Tororo to Nimule (on South Sudan border) and Kampala to Mpondwe (on DRC border).

According to Eng. Kasingye Kyamugambi the Project Coordinator of the Standard Gauge Railway project, this sum will cover construction set up, locomotive costs and provisional services.

Whereas the commencement date remains uncertain, Kyamugambi said that there construction would take 42 months.

“We can’t compare the cost of our (Uganda) railway with that of Kenya since our route will comprise building bridges over swamps, gullies and land.

Also, we are building Class 1 as opposed to Kenya and Ethiopia whose SGR is Class 2” Eng. Daniel Kabogoza the Senior Civil Engineer in charge of Design said during an engagement with the press.

To cross River Nile, the railway line will require a super bridge whose pillars will go 35 metres under the water surface and 42 metres above the water level. The bridge will cost about USD 300 million.

In total, bridges account for 7.8% of Uganda’s 1,000 kms long (from the coast) standard gauge railway which implies even more financial implications.

“Due to the value of soils in wetlands, Uganda will apply more rock fill per kilometer,” Eng. Kabogoza said, adding that there are several valleys and hills between the Malabar – Kampala route.

The average cost per track kilometer will be USD 5.914 million compared to Kenya’s (USD 5.68 million) and Ethiopia (USD 4.471 million).

Regarding the delay in project implementation, Eng. Kyamugambi said land compensation has been the biggest obstacle. He however added that Uganda is still in the process of engaging funding partners like China’s Exim Bank.

Out of the over 6,000 project affected persons that require compensation only 3,000 have been paid so far.

John Holland, a reputable international company in railway operations has been contracted to handle operations on the entire Mombasa – Kampala route.

Benefits

The standard gauge railway will offer an affordable, reliable and efficient transport system. According to the Project Coordinator, “it will reduce costs of transport, raise business volumes and deliver more taxes to government for development”.

Importantly, transportation of cargo from the port of Mombasa in Kenya to Kampala which has always taken 14 days will now be reduced to just 24 hours.

The light railway for passengers will make it convenient for individuals commuting between Kampala, Wakiso and Mukono as well us decongest the roads.

Each cargo train will be carrying 4,000 to 5,000 tonnes which is equivalent to about 106 cargo trucks that ply roads. Government expects this to reduce the pressure exerted on roads which has often led to deterioration costing millions in road repairs.

The construction process is also to boost the local businesses especially those that produce cement and steel which are key components. “Cement for SGR will be 100% locally sourced. We’re engaging steel manufacturers to be able to supply. We are currently working on a capacity building plan but the army (UPDF) will be among those to provide labor. But 90% of the labor will be done by Ugandans,” Kyamugambi said.

February 8, 2017 at 11:54 am #143

Christina Malmberg , the World Bank Country Manager for Uganda during a visit at State House recently said that, Uganda could fail to hit its development aspirations, key among them the achievement of lower middle income status by 2020 if the country doesn’t create buffers against foreign shocks and the domestic slowdown.

In its 8th Economic Update on the state of Uganda’s economy, World Bank the current average growth of 4 to 5% remains lower than required.

“Uganda’s economy is not performing according to expectations. Growth declined by 0.2 percent in the first quarter of 2016/17,” the World Bank assessment released on Tuesday stated.

It attributed the continued ‘weak domestic economic environment’ and slowdown in growth to the low commodity and fuel prices in international markets, the crisis in South Sudan, and severe drought have continued to strain investment and exports.

“This rate of growth is far below the over 10 percent required for the country to out-pace the population growth rate and realize its development aspirations to achieve middle income status by 2020.”

Rachel Sebudde who led the team that made the produced the Economic Update noted that Uganda’s per capita income is growing by 1% far below the 9% if Uganda is to get into middle income status.

As part of interventions to free the economy from these risks, World Bank proposes reforms aimed at stimulating consumers’ access to a wide range of services, and reducing the cost of credit.

“Continuing efforts to strengthen the legal, regulatory, institutional and supervisory framework of the financial sector to ensure it is safe and sound is equally important in restoring consumer confidence,” the report further indicates.

Ms. Christina Malmberg Calvo, the World Bank Country Manager for Uganda in her remarks said; “Increasing access to low cost and safe financial products for firms will spur business investments and economic growth. Similarly, financial products targeted at the informal sector, rural households and women will create jobs and build resilience against shocks.”

The same Assessment however credits strides made to expand the financial sector with more than half the adult population now accessing formal and regulated financial services. “With 7 million active users, mobile money, has greatly increased access to cost effective financial services, such as saving, money transfer, and paying bills,” World Bank observes but also cites low confidence in the formal financial system.

Reacting to the Assessment, Gideon Badagawa the Executive Director Private Sector Foundation Uganda blamed the fiscal policy which they said requires immediate structural adjustments.

“Indiscipline in government borrowing is what has led to the low economic growth. Government should put money in sectors like business development which have short term impact. Investing in infrastructure won’t achieve this,” Badagawa said.

March 21, 2017 at 5:44 pm #568Uganda infrastructural bottlenecks is hurting economic growth

Around 2010, East African leaders realised that infrastructural bottlenecks were hurting economic growth.

Transporting a cargo from Mombasa to Kampala would take almost a month.

So how would the region export its commodities to the world market or even attract wealthy investors to build industries, transfer skills, add value to locally produced products and create jobs?

Usually, investors go to a country like China or Singapore targeting low costs of production and cheap transport to the sea or ocean.

Their products are usually meant for high-end markets in Europe, North America, Asia and other developed countries due to our limited market size and capacity.

For Uganda to achieve objectives of Uganda Vision 2040 such as a GDP per capita of USD 950o, investment in infrastructure projects is unavoidable.

It is equally important to note the worldwide competition of attracting investors by different countries, hence need for an investment climate that is competitive at global stage.

These investors must be assured of reliable, cheap and adequate transport services to the high end markets. Review of world trade and countries’ economic growth trends depict that participating in global value chains is imperative for growth.

It was on this basis that regional leaders including President Museveni, Rwanda’s Paul Kagame, Uhuru Kenyatta, then Tanzania president Jakaya Kikwete and South Sudan’s Salva Kiir decided to take action.

Under the auspices of Northern Corridor Integration Projects (NCIP), the leaders agreed to develop a seamless high capacity, modern, reliable and safe SGR system across the four countries.

The four NCIP Partner states entered into an SGR Protocol to ensure development of the SGR with the same design standards from Mombasa to Nairobi, Kampala, Kigali and Juba.

Regional leaders launching SGR projects in Kampala

Regional leaders launching SGR projects in KampalaIn Uganda the SGR will connect to the DR Congo through Kasese District and Arua District, to Rwanda through Mirama Hills in Ntungamo District to South Sudan through Nimule in Amuru District.

Standard Gauge Railway as a back bone of transport infrastructure must provide a transport service for export and import that is comparable to other services in other countries in terms of quality, cost and reliability.

These countries and their neighbors are at different stages of developing their respective railway systems in order to fully participate in international global trade and production.

Although different political agenda have been set especially on the development timelines, the countries are faced with challenges of raising the necessary resources either internally or through external borrowing.

External borrowing is largely dependent on the country’s GDP, Debt to GDP ratio, Revenue to GDP Ratio, and the country’s risk as assessed by international credit rating agencies.

The table below provides some information on the key macro parameters for the respective countries.

Indicator Uganda Kenya Tanzania Ethiopia Population (Million) 38.32 46.79 52.48 99.47 GDP USD(Million) 25,610 69,170 46,700 69,220 Per Capita Income 668.3 1,478.3 889.9 695.9 Debt to GDP ratio (%) 29.6 48 34.7 49.6 Credit Rating* B B+ NA B Source: The World Factbook- Central Intelligence Agency (2015 figures)

* http://www.tradingeconomics.com-list/rating

Positioning

The Standard Gauge Railway Executive Director, Kasingye Kyamugambi told ChimpReports in an exclusive interview at his office in Kampala that Uganda’s strategic geographical positioning puts it at the heart of the East and Central Africa logistics chain and can evacuate its products through the ports of Djibouti, Mombasa and Dar Es Salaam among others.

“However, due to many factors, the port of Mombasa in Kenya and the port of Dar As Salaam in Tanzania are anchor points for two transport routes—the Northern Corridor and the Central Corridor—both crucial for the domestic, regional, and international trade of five Eastern African countries,” he noted.

The Ugandan taxpayer has in recent years expressed alarm at the cost of infrastructural projects valued in billions of dollars borrowed from China.

The Ethiopian-Djibouti line, which opened in October, cost $3.4 Billion for 656km while the Ugandan leg of 273km will cost $2.3bn. Kenya’s 472km stretch will cost $3.4billion.

Why should Uganda’s railways line be more expensive?

During the interview, Kyamugambi said the construction cost of railways “majorly depends on the unique characteristics of the specific project as determined by the design standard, the geology, terrain and hydrology of the project site.”

Kyamugambi further said the Ministry of Works and Transport carried out a study conducted by an international German consultant Gauff Ingenieure who provided the preliminary Engineering and feasibility study for the Malaba-Kampala SGR based on AREMA[1] standards.

“The consultant estimate without locomotives and rolling stock was USD2.4 billion for an electrified railway system and USD2.0 billion for diesel system,” said Kyamugambi.

“The contract price for the Eastern route, exclusive of locomotives and rolling stock and provisional sums is USD2 billion, but based on superior Chinese standards. Uganda’s contract cost for the Eastern Route of USD2.3 billion therefore includes locomotives, rolling stock and provisional sums,” he elaborated

He emphasised that the contract price and negotiations for the EPC turnkey contract for Malaba-Kampala SGR was based on the Employers requirements derived from the Gauff design, and NCIP agreements which were then provided to CHEC – the contractor.

“It is important to note that the railway systems can all be Standard Gauge but designed to different standards e.g. AREMA or Chinese or British or any other standards.”

Kyamugambi said the Northern Corridor countries agreed on China Class 1 Railway standard to ensure a seamless transport network while Tanzania is basing on AREMA standard while Ethiopia is China Class 2 Standard.

The AREMA standard is not a national standard but a standard of an association of some railways in North America while the Chinese Standard is a national standard.

The railways in the four countries are dominantly freight but will have passenger services.

The passenger trains can move at a faster speed compared to freight trains because they are shorter and lighter while the freight trains are longer and heavier.

Kyamugambi said it is important to differentiate the attainable speeds of passenger and freight trains when analyzing the capabilities of the railway systems.

He further pointed out that Chinese Standards, although engineered from AREMA and British standards are much safer, robust, and durable, for example, the “embankments are higher and compacted to a specified densities, the drainage of the embankment is well done in very strong herringbone structures to protect the embankment leading to lower maintenance cost.”

He said it also has lower operation and maintenance requirements.

Over the last 30 years, it is only China that has invested heavily in railways and used them to catapult their economy, justifying the use of their standard.

Kyamugambi said in railway development, the highest cost is in bridges, followed by the earthworks (embankment), truck, stations, electrification, signaling etc.

For example, on Malaba- Kampala, 35 percent of the route is in bridges, 25 percent is in earth works and 10 percent in track, 10 percent stations, 5 percent electrification, 5 percent in signaling and 10 percent others.

Kyamugambi also pointed to terms of obtaining funds from China.

He said to borrow funds from the China EXIM bank, projects must be designed to Chinese Standards, EPC/Turnkey contracting mode, certain environmental standards must be addressed, and the contractor must be Chinese.

Comparison of Major Characteristics of the Malaba-Kampala and Mombasa-Nairobi SGR Projects

Item Uganda Kenya Route Length 273KM 472KM Track length 338KM 609KM Standard China Class 1 China Class 1 System SGR SGR Traction Electric Diesel welding Continuous Jointed Curvatures 1200/800 1200/800 Gradient 1.2% 1.2% Trailing Load 4000/5000 metric tonne 4000/5000 metric tonne Structure Gauge Double Stack Double Stack Signaling Fully Automatic Fully Automatic Percentage of Bridges along the route 8.8 % of the route 5.9% of the route Super Bridge 1KM Bridge over river Nile None Cost per route Km (excluding locomotives) 7.32m/Km 7.288M/Km Total costs excluding locomotives USD204 Billion USD3.44 Billion Kyamugambi said given that the Ugandan System is electric (at additional cost of 0.54m/km), with a major super bridge over the River Nile, and with 53KM in a swamp, Ugandan Malaba-Kampala SGR cost is comparatively lower than the Mombasa-Nairobi SGR section in Kenya.

Furthermore, the cost per route-KM for the Naivasha- Kisumu section is USD13.7M per route- KM due to its unique characteristics including difficult terrain especially in the rift valley region where major bridges will be required.

He said Uganda deliberately took a decision to invest in an electric system due to the lower operation and maintenance requirements (at least 40 percent) compared to the diesel system.

“This will significantly reduce the project life time cost,” he noted.

Another important question on everyone’s mind is why invest all this money, of all places, in the Northern Corridor?

Kyamugambi explained that the Northern Corridor is the “busiest and most important transport route in East and Central Africa, providing a gateway through Kenya to the landlocked economies of Uganda, Rwanda, Burundi and Eastern DR Congo. It also serves Southern Sudan.”

The less busy alternative transport network serving the landlocked Great Lakes Region, said Kyamugambi, is through Tanzania, called the Central Corridor linked to Dar Es Salaam. This uses Tanzania’s Central Line.

Comparison of the Northern and Central Corridors in respect to competitiveness

ITEM THE NORTHERN CORRIDOR (Mombasa – Kampala)

THE CENTRAL CORRIDOR (Dar Es Salaam-Morogoro-Tabora-Mwanza-Kampala)

Distance 1,250KM 1548KM (1228Km on land and 320km on water) Capacity per day 8640 containers 216 containers (due to limitations on the berth, vessels and loading and offloading time). Each wagon ferry/vessel carries 44 containers. Transit time One day (24hours) Three days per train (72 hours- optimistic) Restrictions No restrictions Some freight like oil products cannot be carried on fresh water Freight Cost USD 100 per tonne USD 124 per tonne Major transshipment None Two- At Mwanza and Port bell. Each vessel carries 44 containers. Thus for a train carrying 215 containers will require 5 vessels to evacuate the freight on the lake Capacity of Port Mombasa port is nearly 3 times bigger than Dar Es Salaam Port Dar Es Salaam, A third of Mombasa Port Current freight to and through Uganda 10 Million 0.5 Million Restriction on goods No restrictions Oil products not allowed on fresh water Access to higher end markets Nearer the Suez Canal the major shipping way Further from Suez canal and will require dedicated Vessels Expected completion time Around 2020 -Kenya has commenced construction of the Nairobi-Naivasha Route and is already sourcing for financing for Naivasha-Malaba section. Left with less than 300km to reach the Uganda Boarder) Around 2030. Tanzania has not commenced development of the 1219km route from Dar Es Salaam to Mwanza. If the route Rusomo, Rwanda and Burundi is done fast, then it may take longer to reach Mwanza Other Infrastructure requirements Railway infrastructure Mwanza Port, Bukasa Port, Railway infrastructure and Vessels He further pointed out that the Northern route is important because the exports of Kenya to Uganda are estimated at about USD 1bn and Uganda imports about 10m tonnes through the northern Corridor.

Kyamugambi said the issue of cargo capacity will be severely limited by the fact that each wagon vessel carries 44 containers whereas a train can carry up to 216 containers. Therefore, each train can only be offloaded on into five vessels requiring about 15 hours to load and offload the vessels.

For the Malaba-Kampala SGR, up to 40 trains can be operated in a day transporting 8,460 containers.

“If such amount of Cargo was going to be transported on the lake, assuming that a massive of five wagon ferries are purchased, we would require 40 days to evacuate cargo of one train,” said Kyamugambi.

“This means that the route not be viable. This coupled with the fact that oil products cannot be transported on fresh water make the Dar Es Salaam Mwanza Kampala Route can only be a minor alternative to the Mombasa-Kampala Route which should be looked at as the bark born of the railway network to the sea.”

Comparison of Malaba-Kampala and Addis Ababa –Djibouti SGR Projects

Item Uganda Ethiopia Route Length 273KM 656KM Track length 338KM 765KM Standard China Class 1 China Class 2 System SGR SGR Traction Electric Electric Tonnage per year Designed for 20-35m tonnes per year Designed for 10-20m tonnes per year welding Continuous Jointed every 300 metres Curvatures 1200/800 m radius 800/600 m radius Gradient 1.2% 1.85%-2.65% Trailing Load 4000/5000 tonnes 3500/4000 tonnes Level Crossings No level crossings Several Level crossings Structure Gauge Double Stack Single Stack Signaling Fully Automatic Semi-automatic Percentage of Bridges 8.8 % of the route 3% of the route Super Bridge 1KM Bridge over river Nile Maximum bridge 155 metres Earth Fill 51,620 m3/KM (365% higher than Ethiopia) 11,110 m3/KM Soil cut 30,510 m3/KM (116% higher than Ethiopia) 26,210 m3/KM Higher Embankments 3634 m3/KM (185% higher than Ethiopia) 1,961 m3/KM Geo-synthetics 19,803 m2/KM (966% higher than Ethiopia due to swamps) 2,050 m2/KM Rock fill 19,640 m3/KM (161% higher than Ethiopia) 12,210 m3/KM Cost of cement USD180/tonne USD125/tonne Cost of steel USD680/tonne USD480/tonne Cost of Diesel USD0.76/Litre USD0.62/Litre Royalties on materials and buying out licenses Land, royalties and licenses Land only Distance from the coast 1,170KM 350KM Cost of financing 85% borrowed/ 15% domestic 55% borrowed/ 45% domestic Cost per route Km (excluding locomotives) USD7.32m/KM USD5.213M/KM Total costs excluding locomotives USD2 Billion USD3.42 Billion Kyamugambi said the Ethiopian system was first designed for Class IV and later upgraded to Class II and this resulted in addenda thus increasing the costs.

There are major differences as illustrated above in the terrain, topography and hydrology of the two project sites thus resulting in higher amounts of rock fill, soil cut, embankments, bridges, geo-synthetics that are major cost centres of railway development.

The Class II system looks cheaper at investment stage but will be more expensive in operation and maintenance. Because of the construction standard requirement.

It is important for railways designed for 100 years to look at life cycle costs rather than investment costs.

For the Uganda project one of the major cost centres is the bridge over the River Nile which is 1KM long whereas in Ethiopia the bridge over Awash is significantly narrow.

Kyamugambi said the design of the Ethiopian route was limited by the capacity of Djibouti Port, adding, “if adjustment factors are made for variances in material costs, quantities, risks, cost escalations and transport, the cost in Uganda should be 2.1 higher than the cost in Ethiopia.”

Comparison of Major Characteristics of the of Malaba-Kampala SGR with the Dar Es Salaam-Morogoro SGR Projects

Item Uganda Tanzania Route Length 273KM 205KM Track length 338KM 300KM Contracting mode** EPC Turnkey (System approach)** Design and Build (Element approach)* Standard China Class 1 AREMA System SGR SGR Traction Electric Electric Welding Continuous Continuous Curvatures 1200/800 mR 1000 mR Gradient 1.2% 1.8%/ 2% Level Crossings No level crossings No Level crossings Structure Gauge Double Stack Single Stack Signaling Fully Automated Fully automated Percentage of Bridges 8.8 % of the route 1.8% of the route Super Bridge 1KM Bridge over river Nile Small bridge over River Ruvu (about 30m wide) Swamps 53KM No major swamp Formation width 7.7 metres 6.6 metres Minimum embankment height 2.5 metres 0.64 metres Cost of cement (Normal grade) USD180/tonne USD110/tonne Cost of steel USD680/tonne USD680/tonne Transportation capacity 22 million tonnes per annum 18 million tonnes per annum Royalties on materials and buying out licenses Land, royalties and licenses Only pay for land Distance from the coast 1,170KM 100KM Cost of financing 85% borrowed/ 15% domestic 50% borrowed/ 50% domestic Cost per route Km (excluding locomotives) USD7.3m/KM USD5M/KM Total costs excluding locomotives USD2.04 Billion USD1.029 Billion The major differences between the Chinese standard and the AREMA standard are: The formation width (top width of embankment) is 7.7 meters for Chinese standards while AREMA is 6.6 meters.

SGR records indicate the height, design and construction of the embankment which is limited to a minimum of 2.5 meters high for Chinese standard and 0.64 meters for AREMA.

These high embankments in the Chinese standards require slope protection.

The Chinese classification requires the herringbone concrete structure for protection of embankments and concrete masonry for higher embankments of 6 meters while this is not a requirement for the AREMA standards require only benching and grassing.

Concrete structures is higher in Chinese standards than the AREMA standards

Concrete structures is higher in Chinese standards than the AREMA standardsKyamugambi said the safety factor in the concrete structures is higher in Chinese standards than the AREMA standards.

“The utilisation of engineering materials especially the geo-synthetics (geogrid and geotextile) for tightening the soft ground, the backfilling material and soft ground treatments are different in both Chinese and AREMA standards,” he observed.

The general design and construction differences in the two standards would therefore make a railway designed and constructed to Chinese standards (which is superior) more expensive than the one designed and constructed to AREMA standards.

Kyamugambi said both the Northern and the central corridor are important for the land locked east African countries but the northern corridor is a more viable route for Uganda as it has a higher potential to spur growth in the country and should be developed fast.

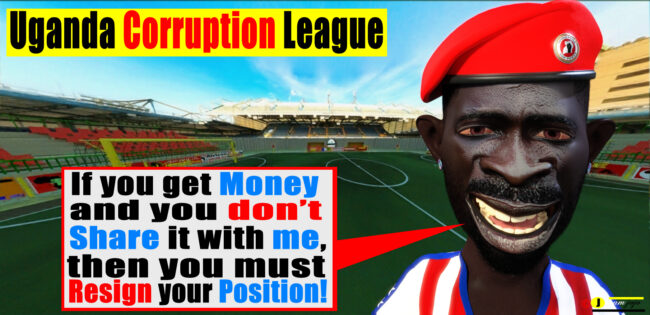

December 11, 2018 at 2:52 pm #48275Corruption is Major challenge to ending extreme poverty

Corruption has a disproportionate impact on the poor and most vulnerable, increasing costs and reducing access to services, including health, education and justice. Think, for example, of the effect of counterfeit drugs or vaccinations on the health outcomes of children and the life-long impacts that may have on them.

Empirical studies have shown that the poor pay the highest percentage of their income in bribes. Every stolen dollar, euro, peso, yuan, rupee, or rouble robs the poor of an equal opportunity in life and prevents governments from investing in their human capital

Corruption erodes trust in government and undermines the social contract, particularly in contexts of fragility and violence, as corruption fuels and perpetuates the inequalities and discontent that lead to fragility, violent extremism, and conflict.

Corruption impedes investment, with consequent effects on growth and jobs. Countries capable of confronting corruption use their human and financial resources more efficiently, attract more investment, and grow more rapidly.

Corruption comes in different forms. It might impact service delivery, such as when police officers ask for bribes to perform routine services. Corruption might unfairly determine the winners of government contracts, with awards favouring friends or relatives of government officials. Or it might affect more fundamental issues of capture, such as how institutions work and who controls them, a form of corruption that is often the costliest in terms of overall economic impact. Each type of corruption is important and tackling all of them is critical to achieving progress and sustainable change.

December 11, 2018 at 2:59 pm #48276Yoweri Museveni Received a Bribe

Before you wonder whether Patrick Ho bribed Kutesa and Yoweri Museveni, let’s refresh our memories and possibly come to a conclusion that to believe or support Yoweri Museveni, you have to be either stupid or brave.

In 1998 Parliament stopped the sale of 49 per cent shares of the Uganda Commercial Bank, then the biggest bank in the country and entirely government-owned, to a Malaysian company. Then Maj. Gen. Salim Saleh resigned as defence adviser, after admitting a role in brokering the deal with Westmont Land Asia, the successful bidder, which had been found to be a “briefcase company” with no banking experience. Gen. Saleh was later alleged to be the majority shareholder in Westmont and soon after the purchase, he sold its shares to Green Land Investments, another company in which he was also a shareholder. In his defence before Chief Magistrate Catherine Bamugemereire over the mismanagement of the now defunct Greenland Bank, Sulaiman Kiggundu, who was the bank’s managing director, named Yoweri Museveni as the “key person” behind the irregular purchase of the UCB shares by Greenland Bank.

A few years back, in 1995, world Bank had recapitalised UCB with USD 60M.During the 1990s, the army was involved in a number of procurement scandals. Undersize uniforms from China, not-up-to-standard food rations from South Africa and 90 second-hand tanks, several unserviceable, from Belarus, were procured. But probably the most famous of the scandals was what came to be known as the junk helicopter scandal, in which two out of four unserviceable Mi-24 helicopters were procured. Four of the MiGs were modified in Israel and delivered in the country but two of them could not fly. The deal to supply the helicopters, which was brokered by Emma Katto, then a race-car driver, was aided by Gen. Salim Saleh, who “convinced” Museveni to okay the deal. Gen. Saleh was as a result to bag a commission of $200,000 off each of the four helicopters. He would later tell a commission of inquiry into the matter in 2001 that he had informed the President of the “commission” he had been promised and Yoweri Museveni had allowed him to use it in the war against Joseph Kony’s rebels in northern Uganda.

Muhwezi, Kutesa were censured in1998.

Then Brig. Jim Muhwezi, the minister of education, was forced to resign by the Sixth Parliament due to alleged mismanagement of the then newly-established Universal Primary Education. The Sixth Parliament, reputed as probably the most independent and vibrant during Museveni’s presidency, also forced Sam Kuteesa to resign, accusing him of benefiting from the sale of the former Uganda Airlines. The two, who were forced to resign over alleged abuse of office, were never prosecuted and bounced back into Cabinet in 2001, when Mr Museveni was re-elected. The government took the view that their censure was “unfair”. Muhwezi, particularly argued further that by having stayed off Cabinet for years, he had been punished enough. Later, he was again dropped from Cabinet over the Global Fund scandal.The Valley Dam Scandal 2003 followed . Shs3.5 billion meant to build valley dams to trap water in the semi-arid areas of eastern Uganda disappeared with no visible valley dams to show for it. It became the talk of town that Dr Specioza Kazibwe, whose Agriculture ministry was supposed to supervise the dam construction, said the valley dams had been built but those who did not want to see them did not see them.

It emerged in 1996 that Danze, a company that belonged to the National Resistance Movement with Museveni as its chairman, had been evading taxes for over a decade. Investigations by the Anti-Smuggling Unit found, for example, that over Shs6b (about $3.4m) had been smuggled over a one-year period. The company, which had been managed by some of the key NRM leaders, including First Deputy Prime Minister Eriya Kategaya, was accordingly disbanded.

During investigations into the Danze issues, M7 was asked about the same. He denied out right. several years later during fundraising for the NRM house, he accused Besigye and Nandala of failing his company that might have generated funds for the party house.In 2003 Complaints of money meant for soldiers who did not exist had been popping up often in earlier years, but in 2003, what came to be known as the ghost soldier scandal clearly unfolded. It emerged that units, especially in northern Uganda where the war against Joseph Kony’s Lord’s Resistance Army was raging, had their numbers exaggerated so that commanders would make a difference off the salaries. The same problem also afflicted military units that operated in the Congo and western Uganda against the Allied Democratic Forces rebels. Some estimates show that Uganda lost about $324 million in 20 years through ghost soldiers.

My friend just hinted that even the budget for the function that was talking about corruption was exaggerated.February 13, 2020 at 11:41 am #48408Uganda Airlines Given to Foreigners

The Ministry of Works and Transport has selected Profiles International to undertake the search process for the chief executive officer of the Uganda Airlines.

Cornwell Muleya a Zambian National is currently Uganda Airlines acting CEO.

Ministry of Works and Transport that last year called for bids of competent firms to undertake the search process, has chosen Profiles International, subject to vetting by the Solicitor General before it can sign the contract.

Profiles International Uganda Limited (PIUL) is an affiliate of Profiles International Inc. (PII), a Waco, Texas, USA-based firm that provides solutions to a wide range of Human Resource challenges.

The firm beat three others in a process that the procurement and disposable unit of the Works Ministry started last month.

The CEO position is open to foreigners to allow a wide range of talent to sustain the recently revived Uganda Airlines.

Before the launch of the airline, Mr Muleya had been serving as a technical adviser with Mr Ephraim Bagenda,an aeronautical engineer, holding the managing director’s role..

However, Mr Bagenda has since been moved to a new position of director of engineering and maintenance.

- AuthorPosts

You must be logged in to reply to this topic.

Regional leaders launching SGR projects in Kampala

Regional leaders launching SGR projects in Kampala

Concrete structures is higher in Chinese standards than the AREMA standards

Concrete structures is higher in Chinese standards than the AREMA standards